Farmers received more than $143.5 billion in federal crop insurance payments from 1995 through 2020, with just under two-thirds paid out for crop damage from drought and excess moisture exacerbated by the climate crisis, according to EWG’s new crop insurance database.

The astronomically high payments are in addition to $103.5 billion in subsidies that went toward farmers’ crop insurance premiums.

These and other findings in the new database are part of our landmark Farm Subsidy Database, which tracks $425 billion in farm subsidies from commodity, crop insurance, disaster and conservation program payments.

The federal crop insurance program was first developed in 1938 following the Great Depression and the Dust Bowl. The program was not widely used by farmers until the Federal Crop Insurance Act of 1980 started subsidizing the cost of insurance policies for farmers.

The crop insurance program has been highly subsidized by taxpayers for many years, and farmers receive indemnity payments when their crop yields or revenue are reduced. Some indemnities come from the money farmers pay, but taxpayers largely fund additional payments when losses exceed premiums. Premium subsidies are paid for solely by taxpayers.

On average, premium subsidies paid for by taxpayers make up around 60 percent of total premiums. Farmers pay only 40 percent of the cost of their insurance policies.

Indemnity payments are often made because of weather-related reductions in crop yield, so crop insurance is tied to climate change. But the federal crop insurance program doesn’t encourage or require farmers to adapt to climate change or reduce greenhouse gas emissions. It often pays farmers for the same type of loss year after year, as with multiple years of payments due to drought.

Reforming the program in Congress’ next Farm Bill so farmers are required to adjust to changes in the climate is key to making U.S. agriculture more resilient to extreme weather events.

This article discusses only crop insurance indemnities. For more information about subsidies, indemnities or the federal crop insurance program, see EWG’s Crop Insurance Primer.

Climate ‘causes of loss’ affect crops across U.S.

The “cause of loss” is the main reason for a reduction in crop yield or revenue that triggers a crop insurance payment. Causes of loss are factors that damage crop yield, such as drought, excessive rain or hail, or a decrease on the price side of farmer revenues, such as a decline in crop price.

Many crop insurance causes of loss result from adverse weather, which is made worse by the climate emergency. So insurance losses are also directly tied to climate change. As extreme weather has become more frequent, the climate crisis has already increased insurance payments and premium subsidies. These costs are expected to go up even more, as climate change causes even more unpredictable weather conditions.

Most crop insurance indemnities between 1995 and 2020 were paid for weather-related causes of loss. Table 1, below, provides the five causes of loss with the most payments. Among them, drought and excess moisture, precipitation and rain stand out, making up more than 61 percent of all crop insurance payments during that period.

Table 1. The top five causes of loss accounted for almost $113.2 billion in indemnities between 1995 and 2020

|

Cause of loss for crop insurance payment |

Total indemnities |

|

Drought |

$48,633,395,480 |

|

Excess moisture/precipitation/rain |

$38,984,412,139 |

|

Hail |

$9,704,733,932 |

|

GRP/GRIP/ARPI/SCO/STAX/MP/HIP WI crops only * |

$8,156,944,228 |

|

Decline in price |

$7,770,562,653 |

Source: EWG, from USDA Risk Management Agency, Cause of Loss Historical Data Files

*Types of insurance policies; details on the RMA website. Indemnities for GRP/GRIP crops between 1995-2013; indemnities for ARPI, SCO, STAX, MP, HIP, WI crops 2014-2020.

Drought and excess moisture are both affected by climate change. Droughts are increasing in some parts of the country, and more frequent and extreme precipitation is rising in others. Both are expected to get worse in coming decades.

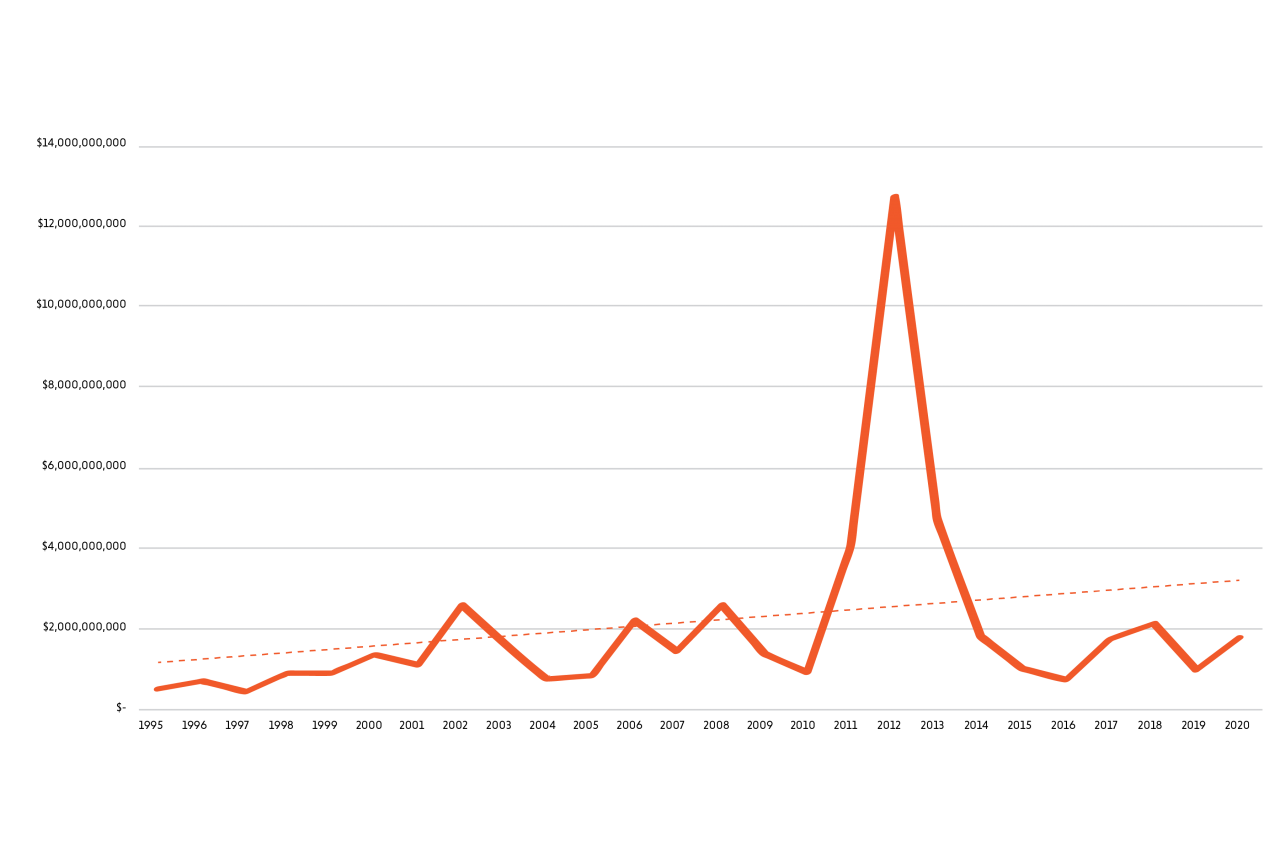

Insurance indemnities for both causes of loss have gone up over time. Indemnities for drought were $325.6 million in 1995 and rose to $1.65 billion in 2020 – an increase of more than 400 percent (Figure 1).

Excess moisture indemnities were $685.4 million in 1995 and increased to $2.6 billion in 2020, a growth of almost 300 percent (Figure 2). The years in between 1995 and 2020 also had spikes in payments for both causes of loss.

Figure 1. Drought indemnities increased between 1995 and 2020

Source: EWG, from USDA Risk Management Agency, Cause of Loss Historical Data Files

Figure 2. Indemnities for excess moisture increased between 1995 and 2020

Source: EWG, from USDA Risk Management Agency, Cause of Loss Historical Data Files

Top counties with drought and excess moisture payments

The counties that received the most drought and excess moisture payments are located where you might expect.

The 10 counties with the largest drought indemnities were in Texas, which has gotten hotter and drier (Table 2). According to the Fourth National Climate Assessment, temperatures in Texas have increased since the early 1900s, and droughts are common, as recently as the early 2010s.

Table 2. The 10 counties with the highest drought indemnities between 1995 and 2020 were all in Texas

|

County |

Drought indemnities |

|

Dawson |

$429,271,348 |

|

Lynn |

$354,208,734 |

|

Nueces |

$338,834,391 |

|

Martin |

$300,666,509 |

|

Howard |

$267,753,766 |

|

San Patricio |

$244,976,903 |

|

Fisher |

$224,054,002 |

|

Terry |

$220,963,156 |

|

Lubbock |

$220,304,236 |

|

Hockley |

$212,185,272 |

Source: EWG, from USDA Risk Management Agency, Cause of Loss Historical Data Files

Of the 10 counties with the highest excess moisture indemnities, the top was Brown County, S.D. The others were in North Dakota (Table 3). These states have gotten wetter in recent years – in both North and South Dakota, large precipitation events happen more often. Both states have seen an above-average number of large rain events, going back to 1990.

Table 3. One of the 10 counties with the highest excess moisture indemnities between 1995 and 2020 was in South Dakota, with the rest in North Dakota

|

County |

State |

Excess moisture indemnities |

|

Brown |

S.D. |

$460,308,408 |

|

Cass |

N.D. |

$333,997,732 |

|

Cavalier |

N.D. |

$322,074,826 |

|

Ramsey |

N.D. |

$321,452,216 |

|

Grand Forks |

N.D. |

$314,068,066 |

|

Bottineau |

N.D. |

$302,620,692 |

|

Dickey |

N.D. |

$283,015,407 |

|

Stutsman |

N.D. |

$280,278,703 |

|

Barnes |

N.D. |

$274,650,869 |

|

Ward |

N.D. |

$267,514,912 |

Source: EWG, from USDA Risk Management Agency, Cause of Loss Historical Data Files

More drought is expected in the drought areas, and areas with excess moisture are expected to get wetter because of climate change. So crop insurance indemnities for these causes of loss will grow.

The climate crisis has already increased the cost of the federal crop insurance program, and will certainly do so in the future..

The upcoming Farm Bill, which Congress will consider in 2023, is a once-in-a-lifetime chance to reform federal farm policies, including crop insurance, so they encourage farmers to adapt to climate change and reduce emissions before it’s too late. Making changes to these programs now will be key to making U.S. agriculture more resilient to the extreme weather that lies ahead.

EWG will be at the forefront of proposing agricultural policy reforms to make the 2023 Farm Bill focus more on how to effectively fund farm programs so that farmers can adapt to and fight the climate crisis.